What Does Paul B Insurance Medicare Agency Huntington Do?

The Centers for Medicare & Medicaid Provider (CMS) runs the Medicare program, however it doesn't establish that's eligible. Age 65 or older Special needs - those who have actually been getting impairment advantages for at least 24 months Illnesses such as end-stage kidney illness (ESRD) or amyotrophic side sclerosis (ALS) If you currently get Social Protection or Railroad Retired Life Board (RRB) benefits when you gain eligibility for Medicare wellness insurance policy, Uncle Sam may instantly enroll you.

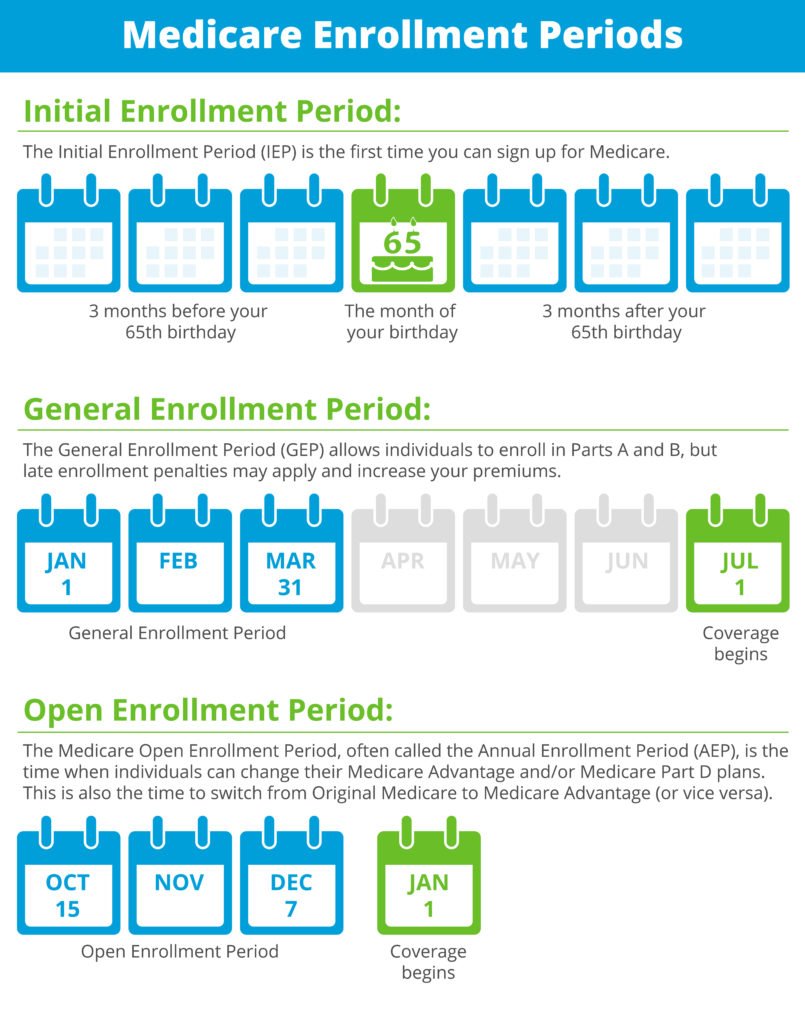

The majority of people very first sign up with the ranks of Medicare beneficiaries the month they transform 65. If you qualify for Medicare this means, your Preliminary Enrollment Period will certainly start three months before the month you transform 65.

Paul B Insurance Medicare Insurance Program Huntington for Dummies

In enhancement to the above ways to receive Medicare health and wellness insurance, you might likewise be eligible if you have among the list below conditions: To certify, you have to require regular dialysis or a kidney transplant, and also your coverage can start soon after your first dialysis treatment. If you get a transplant as well as no more need dialysis, you'll lose Medicare eligibility.

You may be able to start taking out Social Safety benefits for retired life at age 62, Medicare isn't readily available to most individuals up until they turn 65. If you are under the age of 65, you might be qualified for Medicare if you meet any of the adhering to requirements. You have actually been getting Social Protection handicap benefits for a minimum of 24 months.

You have Lou Gehrig's illness (ALS). You have ESRD requiring routine dialysis or a kidney transplant, as well as you or your spouse has actually paid Social Safety taxes for a length of time that relies on your age. If none of these scenarios relate to you, you'll have to wait till age 65 to begin obtaining your Medicare benefits.

Facts About Paul B Insurance Medicare Agency Huntington Revealed

There are 2 ways to sign up in Medicare: You will certainly be signed up in both Part An and Part B upon reaching age 65. Concerning 3 months prior to your 65th birthday celebration, you should receive a mail, informing you of your registration in Medicare. You will certainly be signed up in both Component An as well as Part B, starting with the 25th month that you are qualified for Social Protection special needs insurance (SSDI) advantages.

If you do not want Part B benefits, you should alert Social Safety in contacting decrease the insurance coverage. If you are not enlisted in Medicare as described previously, you will require to apply. Your application must be made throughout a 7-month duration based upon when you transform age 65.

See This Report on Paul B Insurance Medicare Part D Huntington

It is important to apply for my aetna supplemental Medicare when you transform 65. You are allowed to delay enlisting partially B without fine under the following circumstances: You are age 65 or over as well as you have group medical insurance based on your very own or your partner's current employment; or You are handicapped, and also you have team health and wellness insurance policy based on your present employment or the present work of a family members member.

I accredit I am a health and wellness treatment company, a staff member of a health and wellness care provider, a business partner of a wellness care company, or a staff member of a business associate, and also the purpose of my access to any kind of Virginia Premier System is connected to the provision or payment of health and wellness care services (paul b insurance medicare health advantage huntington).

This includes full conformity with the Wellness Insurance Coverage Mobility and also Liability Act of 1996 ('HIPAA'), the HITECH Act, and also the Virginia Wellness Records Personal Privacy Act, and suitable guidelines to these legislations. I agree to keep personal all details relevant to Virginia Premier System service, consisting of, but not restricted to, quality and risk administration activities as well as other confidential or individual information worrying the medical, personal, or organization affairs of Virginia Premier System and its participants.

Some Known Factual Statements About Paul B Insurance Medicare Advantage Plans Huntington

When you end up being qualified for Medicare, there's a great deal to think about. It is essential to understand just how this type learn the facts here now of protection harmonizes coverage with Covered California and also the steps you'll need to require to transition to Medicare on schedule. Medicare is a government medical insurance program for people that are 65 or older, particular younger people with disabilities and also people with irreversible kidney failing.

If you are presently a Covered The golden state enrollee and become qualified for or are enlisted in Medicare, you may need to take instant activity to prevent economic penalties and also gaps in health and wellness coverage. You can get totally free therapy regarding your Medicare eligibility and also registration alternatives, consisting my site of whether you get approved for programs to lower your Medicare costs, by calling the Medical insurance Counseling as well as Campaigning For Program (HICAP) at (800) 434-0222. paul b insurance medicare agent huntington.